In today’s unpredictable economy, many investors are turning to strategies that offer reliable returns without constant monitoring. One of the most appealing approaches is building a dividend portfolio, which focuses on stocks that pay regular dividends to shareholders. This method not only provides a steady stream of passive income but also allows for potential capital growth over time. If you’re new to this, dividend investing for beginners can seem daunting, but with the right steps, anyone can create a portfolio that generates consistent cash flow. As we head into 2025, with interest rates fluctuating and market volatility on the rise, dividend portfolios have become even more attractive for those seeking financial stability.

A well constructed dividend can serve as a foundation for long term wealth building. Imagine waking up to quarterly or monthly payments deposited into your account, covering expenses or reinvested to compound your returns. In this comprehensive guide, we’ll walk through everything you need to know about how to start dividend investing, from setting goals to selecting the best assets. By the end, you’ll have a clear roadmap to create your own portfolio tailored for passive income dividends.

Understanding Dividends and Why They Matter for Passive Income

Before diving into the mechanics of building a dividend, it’s essential to grasp what dividends are and how they contribute to passive income. Dividends are portions of a company’s profits distributed to shareholders, typically on a quarterly basis, though some pay monthly or annually. These payments come in cash or additional shares and are a sign of a company’s financial health and commitment to rewarding investors.

For passive income seekers, dividends are gold because they require minimal effort once the portfolio is set up. Unlike active trading, where you buy and sell frequently, dividend investing emphasizes holding quality stocks long-term. In 2025, with inflation concerns lingering, dividends that grow over time can act as an inflation hedge, preserving your purchasing power. For instance, companies with a history of increasing payouts known as dividend growth stocks can provide rising income streams that outpace rising costs.

The dividend yield is a key metric: it’s calculated as the annual dividend per share divided by the stock price. A higher yield means more immediate income, but sustainability is crucial. Chasing ultra high yields without checking fundamentals can lead to dividend cuts, disrupting your passive income flow. Instead, focus on balanced yields around 3-5% for stability. This foundational knowledge ensures you’re ready to build a portfolio that aligns with your passive income goals.

The Benefits of a Dividend in 2025

Why choose dividend investing over other strategies? First, it offers compounding power through reinvestment. By using dividend reinvestment plans (DRIPs), your payouts buy more shares automatically, accelerating growth exponentially. Over decades, this can turn a modest investment into a substantial nest egg, making it a cornerstone of wealth-building strategies.

Another advantage is lower volatility. Dividend-paying companies are often mature giants in stable sectors like consumer goods, healthcare, and utilities. They weather economic downturns better than growth stocks, providing a buffer during market dips. In the current 2025 landscape, where economic uncertainties persist, this stability is invaluable for those seeking reliable passive income.

Tax efficiency is another perk. Qualified dividends are taxed at lower capital gains rates (0-20%) rather than ordinary income rates, especially in tax-advantaged accounts like IRAs. This means more money stays in your pocket to reinvest or spend. Plus, dividends encourage disciplined investing focusing on quality over hype reduces emotional decisions driven by market swings.

Finally, dividend portfolios align perfectly with retirement goals. Many retirees aim for the “4% rule,” withdrawing 4% annually from their portfolio. A dividend focused setup can generate this income without selling assets, preserving principal for future needs or heirs. These benefits make dividend investing a timeless strategy for financial independence.

Step 1: Define Your Investment Goals and Risk Tolerance

The first step in how to build a dividend portfolio is clarifying your objectives. Are you aiming for immediate passive income to supplement your salary, or long-term growth for retirement? Your goals will shape your strategy. For example, if you’re in your 30s, you might prioritize dividend growth investing to build wealth over decades. Retirees, however, may lean toward high-yield dividend stocks for current cash flow to cover living expenses.

Assess your risk tolerance carefully. Dividend investing isn’t risk free stock prices fluctuate, and companies can cut dividends during tough times. Conservative investors should stick to blue-chip stocks with low payout ratios (under 60%), ensuring dividends are sustainable even in downturns. Use tools like a risk assessment quiz from your brokerage to gauge your comfort level with market swings.

Set a target income to guide your efforts. Suppose you want $1,000 monthly in passive income. At a 4% average yield, you’d need a $300,000 portfolio. Break it down: start with $50,000 and add regular contributions. Track progress with apps that project future dividends based on your holdings. Clear goals and risk awareness set the stage for a portfolio that delivers reliable passive income dividends.

Step 2: Educate Yourself on Dividend Basics

Knowledge is power in dividend investing. Start by learning key terms: payout ratio (percentage of earnings paid as dividends), free cash flow (cash available after expenses for dividends), and ex-dividend date (cutoff to receive the next payout). These metrics help you evaluate a stock’s dividend reliability.

Explore sectors: utilities and real estate investment trusts (REITs) offer high yields but can be sensitive to interest rate changes, while consumer staples provide stability. In 2025, consider trends like companies prioritizing sustainable practices, as they often have more reliable dividends. Books, blogs, or podcasts on dividend strategies can deepen your understanding. This education ensures you make informed choices when selecting stocks for your portfolio.

Step 3: Choose the Right Investment Account

Selecting the right account is critical for maximizing your passive income and minimizing taxes. For U.S. investors, a Roth IRA allows tax-free withdrawals, ideal for long-term dividend growth. Traditional IRAs defer taxes until retirement, preserving more capital upfront. Taxable brokerage accounts offer flexibility but incur annual taxes on dividends, so weigh the trade-offs.

If you’re employed, max out a 401(k) with dividend-focused funds. International investors might use tax-advantaged accounts like ISAs. Choose brokers with low fees and DRIP options to keep costs down, as fees can erode your passive income over time. Fund your account strategically: automate monthly transfers to build steadily. Dollar-cost averaging investing fixed amounts regularly reduces the risk of buying at peak prices.

Step 4: Research and Select Dividend Stocks and ETFs

The heart of building a dividend portfolio is picking the right assets. Focus on quality over quantity. Dividend Aristocrats companies with 25+ years of consecutive dividend increases are excellent for stability. Examples include a consumer goods giant yielding 2.6%, a healthcare leader at 3%, or a beverage company at 2.9%. These firms have proven resilience through economic cycles.

For higher yields, consider REITs yielding around 5-6% or energy companies at 4%. These offer strong income but require scrutiny for sustainability. ETFs are a great way to diversify without picking individual stocks. A popular high-dividend ETF yields about 3% with low fees, while another blends yield and growth at 3.5%. For aggressive investors, a REIT focused ETF might yield over 9%, though with higher risk.

Screen stocks using online tools, focusing on low debt-to-equity ratios, consistent earnings growth, and payout ratios under 70%. Avoid yield traps stocks with 10%+ yields often signal financial distress. A balanced mix of individual stocks and ETFs ensures steady passive income dividends with manageable risk.

Step 5: Diversify Your Holdings

Diversification is key to reducing risk in your dividend portfolio. Aim for 20-30 stocks across 5-7 sectors: consumer staples, healthcare, financials, energy, and industrials. This spreads exposure to economic shifts. For example, allocate 40% to Dividend Aristocrats for stability, 30% to high-yield plays like REITs, and 30% to ETFs for broad market exposure.

Geographic diversity adds another layer consider international dividend ETFs for exposure to global markets. A sample $50,000 portfolio might include $10,000 in a high-dividend ETF, $10,000 in a growth-focused ETF, and $5,000 each in five individual stocks across sectors. This targets a 3-4% yield while cushioning against sector-specific downturns.

Step 6: Implement Dividend Reinvestment and Monitoring

To maximize returns, enroll in DRIPs to automatically reinvest dividends into more shares. Many brokers offer fractional shares, ensuring every dollar compounds. Monitor your portfolio quarterly: check earnings reports for dividend changes or red flags like declining revenue. Use apps to track ex-dividend dates and payment schedules.

Rebalance annually sell overperforming assets and buy underperformers to maintain your target allocation. In 2025, keep an eye on economic shifts, like potential rate cuts, which could boost dividend stock performance. Regular oversight ensures your portfolio stays aligned with your passive income goals.

Example Dividend for Beginners in 2025

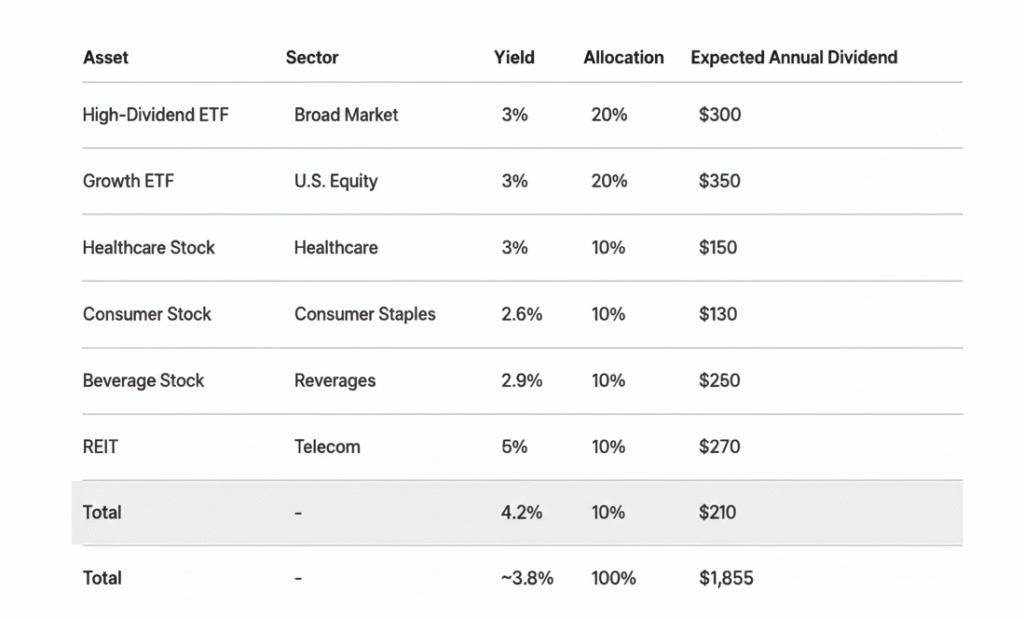

Let’s build a sample $50,000 portfolio for passive income:

- ETFs (40%): $10,000 in a high-dividend ETF (3% yield), $10,000 in a growth-focused ETF (3.5% yield).

- Dividend Aristocrats (30%): $5,000 in a healthcare stock (3% yield), $5,000 in a consumer staples stock (2.6%), $5,000 in a beverage stock (2.9%).

- High-Yield Stocks (30%): $5,000 in a REIT (5.4%), $5,000 in a telecom stock (6%), $5,000 in an energy stock (4.2%).

Estimated annual income: $1,800-$2,200, or $150-180 monthly. Reinvest via DRIPs to grow over time. For a $300,000 portfolio aiming for $1,000/month, scale up allocations, adding high-yield assets like business development companies or additional REITs.

This image shows a balanced approach for passive income dividends, blending stability and income.

Common Mistakes to Avoid When Building Your Portfolio

New investors often make avoidable errors. Chasing ultra-high yields (10%+) without due diligence can lead to dividend cuts, as these stocks may face financial trouble. Always check payout ratios and earnings stability. Another mistake is neglecting diversification—overloading in one sector, like REITs, exposes you to sector-specific risks.

Don’t ignore total return. Dividends are great, but capital appreciation matters too. A stock with a 3% yield and 5% annual price growth outperforms a 5% yield with stagnant prices. Avoid timing the market—focus on consistent investing rather than trying to predict dips. Lastly, don’t skip ongoing monitoring; even stable companies can face challenges. Avoiding these pitfalls ensures your portfolio delivers reliable passive income dividends.

Building Your Dividend Portfolio

Building passive income is a rewarding journey that combines strategy, patience, and discipline. By setting clear goals, educating yourself, choosing the right accounts, and selecting quality stocks and ETFs, you can create a reliable income stream that grows over time. Diversification and reinvestment amplify your returns, while regular monitoring keeps your portfolio on track. Whether you’re starting with $5,000 or $500,000, the principles of dividend investing for beginners apply universally.

Start small, stay consistent, and let compounding work its magic. In 2025, with economic shifts on the horizon, a well-crafted dividend portfolio offers both stability and opportunity. Take the first step today, and soon, you’ll see those dividend payments rolling in, building the foundation for your financial future.